SLV Water District: Understanding Capital Obligations

By Bob Fultz

In earlier articles, we examined SLVWD’s operating expenses, which have skyrocketed over the last decade in excess of inflation. This resulted, over the last 25 years, in almost $40 million dollars diverted to operating expenses rather than being used for infrastructure improvements and rate relief.

In this article, we’re going to close the loop on how that diversion seriously impacts our community by examining more closely the District’s “capital obligations”.

Capital obligations include 1) debts that the District has incurred, which need to be paid to “catch up”, and, 2) investments the District needs to make going forward in order to maintain a viable, independent system.

The chart below illustrates the first category. This analysis assumes the District can obtain grant funding for all of the fire mitigation work needed and that CZU recovery is fully funded by the surcharge recently enacted. The total “catch-up” debt is about $20.5 million. As you can see, the $40 million diverted to operating expenses in excess of inflation would have covered these catch-up expenses—and then some.

The remaining categories are unlikely to be eligible for either grant funding or FEMA reimbursement, with the possible exception of replacing the legacy redwood tanks (about $3.5 million) in the event those are damaged in a significant disaster—if such a disaster occurs before we replace them anyway as many of those tanks are at the end of their design life.

By way of comparison, budgeted operating expenses for the current fiscal year are about $9.2 million forecasted to go to $11.2 million in 5 years for an average growth of about 6.8% per year.

Conversely, the money needed to tap into our allotment from Loch Lomond (one of the enhancement projects above—also envisioned by the Santa Margarita Groundwater Agency) may be eligible for some grant funding to construct—but most likely not the cost to operate it.

The second category includes spending on infrastructure improvements along with keeping reserve and pension accounts refreshed every year with incremental funding—mainly to cover inflation. This second category examines the main infrastructure categories that need, over time, repair or replacement—from the water collection/generation points all the way to and including your meter.

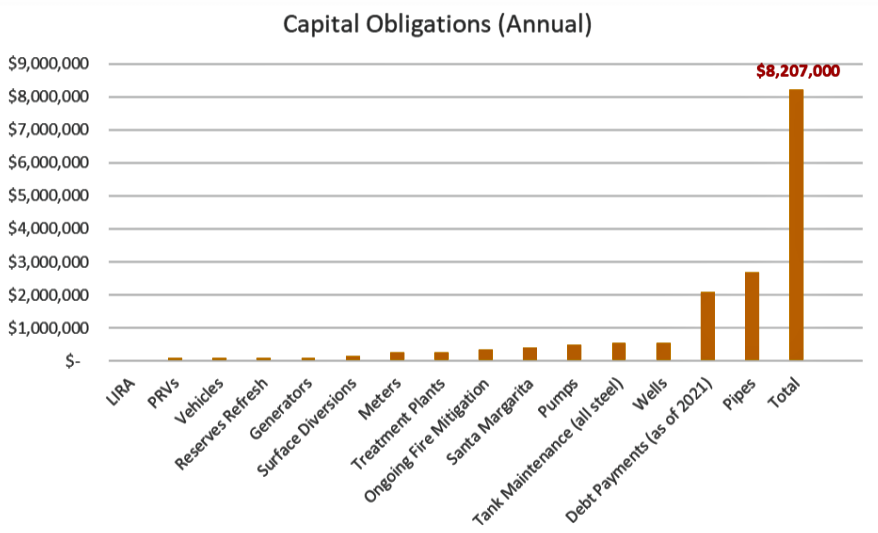

As you can see in the chart below, the two big categories are debt payments (showing current amounts) and replacing pipes. Even with an estimated life of 100 years for new pipe, we need to replace about 1% per year. According to our 2020 annual report, we have 170 miles of pipe. Replacing 1% per year on average means replacing 1.7 miles of pipe per year at an average cost of about $300 per foot for a total of $2.7 million a year just in replacing pipe. And given the age of some of our pipe, we may need to play “catch up” here as well.

Currently, the District has about $4.2 million per year to spend on both “catch-up” and “annual” capital obligations—and that number is forecasted to shrink over the next 5 years.

If the Board were to establish a policy to increase operating expenses by 4% a year over the next 5 years, the District would accrue about $24.5 million to apply to our capital obligations instead of the budgeted $20 million. A positive $4.5 million is a huge difference that will continue to grow over time as we work towards paying down our capital obligations. That is the key: time and compounding. These obligations were built up over decades. It will take time to pay them off. However, the longer we wait to make these policy changes, the larger the unpaid capital obligations.

Recently, there was a proposal made to merge SLVWD with the Scotts Valley Water District. The community, quite rightly, in my opinion, expressed a very strong preference to stay independent. While this merger proposal has been shelved, for now, there were certain Board members expressing both support for moving forward now as well as support for revisiting it later.

However, if our community wishes our District to stay independent then we must get on a better path with respect to fiscal policy. The first step in establishing good fiscal policy, or any policy, is to be transparent—and identify the challenges. As a first step, the SLVWD Board needs to establish a policy to include a more comprehensive review of the District’s true financial condition in its annual report—like the numbers presented here. And then the Board needs to engage the community in a discussion about how to address these financial realities, culminating in a strategic plan that reflects the solutions.

And a second step is an established policy around growth in operating expenses, recognizing that skyrocketing growth in operating expenses directly impacts our ability to address our District’s capital obligations, as shown here as well.

In the end, change happens when it is supported by a broad base of Owners—meaning all of you. The path to a healthy District with a stable fiscal policy, sound infrastructure, and with affordable water rates can only be achieved if we, acting as a community, take action.

Bob Fultz is a member of the San Lorenzo Valley Water District Board of Directors, but is speaking only for himself in these columns. He is a resident of Boulder Creek and CFO at Range Networks.

The San Lorenzo Valley Post is your essential guide to life in the Santa Cruz Mountains. We're dedicated to delivering the latest news, events, and stories that matter to our community. From local government to schools, from environmental issues to the arts, we're committed to providing comprehensive and unbiased coverage. We believe in the power of community journalism and strive to be a platform for diverse voices.