Could the Housing Market be Shifting?

By M.C. Dwyer

For years, everyone in the housing market has been lamenting the housing shortage – not enough homes for sale to satisfy buyer demand. That created a sellers’ market with multiple offers leading to rising home prices. But recently I’ve watched a new trend emerging on my daily hotsheet on the MLS: the number of homes sold has been varying at between one half and one quarter of the number of new homes for sale (listings) on the market. A stable market would have roughly the same number of new listings as sales.

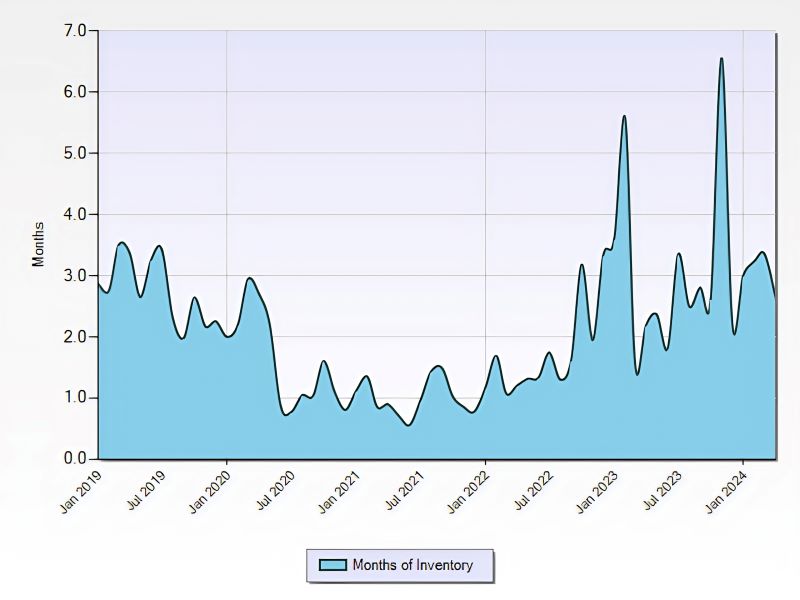

The chart above shows San Lorenzo Valley single family housing inventory changing over time. Inventory is the ratio between the number of homes for sale and the number of sales. Typically inventory under 4-6 months is a sellers’ market, while anything over that is considered a buyers’ market. We haven’t had a sustained buyers’ market here since around 2009-2012 or so: it usually means more buyers are able to negotiate better deals for themselves.

Over the past 5 years, anytime there was a spike in inventory, it resolved itself pretty quickly as buyers came in and bought more homes. Scotts Valley single family residences charted similarly.

Where are the buyers today? The affluent and well paid are better positioned to buy homes now, and they’ve been supporting the market. Not surprisingly, the combination of high prices and high mortgage rates hurts affordability – forcing many would-be first-time and lower income buyers to the sidelines. Increasingly though, more sellers are willing to negotiate: helping buyers reduce their mortgage rate – these are called “buy downs” or “closing cost credits.”

But another barrier facing SLV home sales is that most new homeowners won’t be able to find conventional insurance, ending up on the California Fair Plan for fire insurance, often paying rates of $7,000 and up. Cal Fair often takes weeks longer to provide coverage, postponing escrow closings. Buyers also need to pay for a second home insurance policy to cover everything Cal Fair doesn’t.

CNBC recently reported that, even though mortgage rates fell recently to the lowest point since April, “buyers are still struggling to afford today’s housing market. As a result, mortgage demand flattened at a weak pace.” At press deadline, the 30-year fixed conventional mortgage rates decreased to 7.08% after being closer to 7.5% at the end of April.

But, “Applications for a mortgage to purchase a home…were 14% lower than the year earlier. The drop was driven by a 9% decline in FHA applications. Those loans are favored by first-time or lower income buyers because they allow much smaller down payments than conventional loans.”

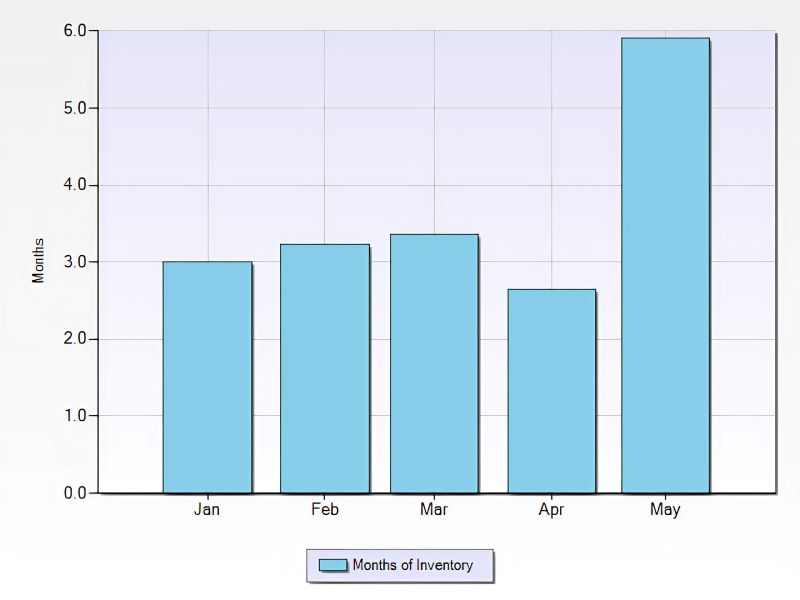

Now let’s zoom in to the chart for the SLV this year so far. To normalize the surge in inventory will require some combination of more buyers, or, some sellers taking their homes off the market. Experts and traders are betting the Federal Reserve won’t lower its inter-bank lending rate until they’re confident inflation is under control; most now say September at the soonest. It’s likely that home buyer demand that’s been postponed since last fall will surge when mortgage rates fall.

Nationally, REALTOR.com notes that “The median down payment on a home purchase was an average of 13.6%.” While the often touted ideal 20% down payment often allows buyers to get better rates and avoid mortgage insurance, there are loans with down payments as low as 3.5% and even 0% down (for rural areas, moderate income buyers, and veterans).

REALTOR® Compensation

Since the National Association of REALTOR®S (NAR) announced their proposed legal settlement a couple of months ago, (still awaiting final approval), a few issues have come up which really need solutions. For example, VA (Veteran) buyers can’t pay their buyers’ agent’s compensation. To allow more time for a smoother implementation, the new regulations now take effect mid August. NAR has an FAQ page on their website now: nar.realtor/the-facts/nar-settlement-faqs.

Our Rebuild

After waiting six months for the SBA to review Mark’s loan application to cover around $40,000 of extra property expenses (contractor’s final bills), his application was denied.

It has come to our attention that the Fire Recovery Permit Center Dashboard website, which we relied on to try to comprehend the tragically low number of homes getting rebuilt, also includes ordinary building permits completely unrelated to the August 2020 CZU Lightning Fires.

No homes finished rebuilding according to the Fire Recovery Permit Dashboard last month, leaving the total at just 69 homes rebuilt, out of the over 920 homes lost to the 2020 CZU Lightning fires. By my calculations, that’s just 7.7%. 142 permits have either been issued or are ready, and 227 permits are in process – down from one from last month.

Send your questions & topic requests to “M.C.” (MaryCatherine) Dwyer, MBA, REALTOR®

(831) 419-9759 E-mail: mcd@mcdwyer.com Website: https://mcdwyer.exprealty.com

CA DRE License 01468388 EXP Realty of California, Inc.

Serving San Lorenzo Valley and Scotts Valley since 2005

Sources: California Association of REALTORs, CNBC, CNN, MLS as of 5/17/2024, Mercury News, Mortgage News Daily, National Association of REALTORs, Redfin, Reuters. Yahoo! and Zillow.

The statements and opinions contained in this article are solely those of the individual author and her sources, and do not necessarily reflect the positions or opinions of eXp Realty, LLC, or its subsidiaries or affiliates (the “Company”). The Company does not assume any responsibility for, nor does it warrant the accuracy, completeness or quality of the information provided.

The San Lorenzo Valley Post is your essential guide to life in the Santa Cruz Mountains. We're dedicated to delivering the latest news, events, and stories that matter to our community. From local government to schools, from environmental issues to the arts, we're committed to providing comprehensive and unbiased coverage. We believe in the power of community journalism and strive to be a platform for diverse voices.