Housing Market Update November 2024

By M.C. Dwyer

The housing market tends to slow in November as people begin to plan for winter holidays, and home touring activity is affected by the weather. This year, home buyers and sellers are also contending with war in the Middle East, political uncertainty in the US, and higher mortgage rates.

As California retains the #1 position with the most expensive homes in the nation, the average home buyer seems to be taking a break. Common reasons include hoping for lower prices or lower mortgage rates. Unless a property is really competitively priced — i.e. below buyer expectations — attendance at open houses and private showings is slowing. The best marketing is ineffective if the property price is out of line with location, condition, and property appeal; the property may linger on the market longer before getting an offer.

fixed mortgage rates quickly spiked back up — from 6.15% to 6.7% over the last 30 days.* Several key economic reports came in stronger than expected, and inflation was back up ov

Despite the Federal Reserve dropping their lending rate by ½% in September, 30 year fixed mortgage rates quickly spiked back up — from 6.15% to 6.7% over the last 30 days.* Several key economic reports came in stronger than expected, and inflation was back up over 3%. (The Feds are aiming for 2%).

In the investment world, a stronger economy casts doubt on the likelihood that the Federal Reserve will lower their bank lending rate this year. Bond values are highly sensitive to rate changes, leading to higher mortgage rates. Nationally, applications for home purchase loans are wobbling in response to rate changes, but indicate a few more buyers entering the market: around 7% more than last year.

Local Housing Market Insights

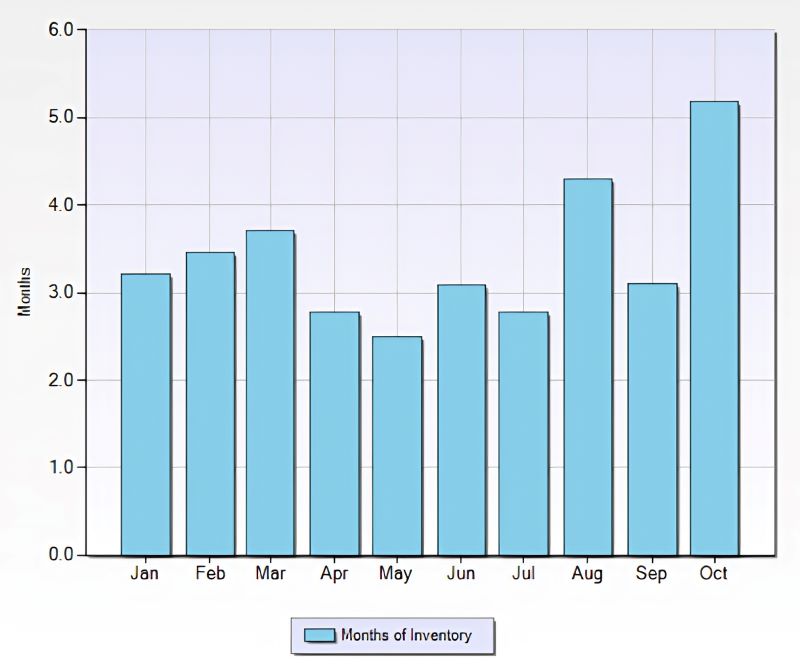

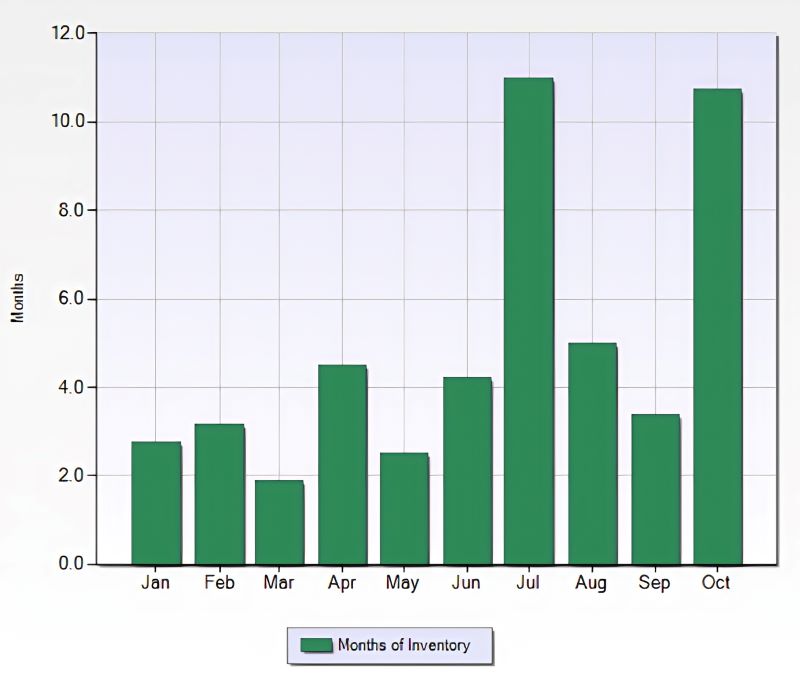

For the past few months, more home sellers put their home on the market each week than buyers made offers, across the San Lorenzo Valley (see image above). The imbalance between the number of sellers compared to serious buyers means homes are taking longer to sell now, sometimes making it easier for buyers to negotiate with sellers, depending on the sellers’ circumstances. In this transitional market, it’s especially important to consult a REALTOR®about hyperlocal trends. For example, we just shared this chart with a Boulder Creek homeowner considering selling. This illustrates the growing inventory of homes for sale in Boulder Creek, which tends to offer more “affordable” properties than other parts of SLV. Traditionally, when the inventory is above six months, it’s considered a buyers’ market. Under six months is considered a seller’s market.

In this transitional market, it’s especially important to consult a REALTOR®about hyperlocal trends – for example, we just shared this chart above with a Boulder Creek homeowner considering selling. This illustrates the growing inventory of homes for sale in Boulder Creek, which tends to offer more “affordable” properties than other parts of the SLV. Traditionally, when the inventory is above six months, it’s considered a buyers’ market. Under six months is considered a sellers’ market, but this is just a generalization.

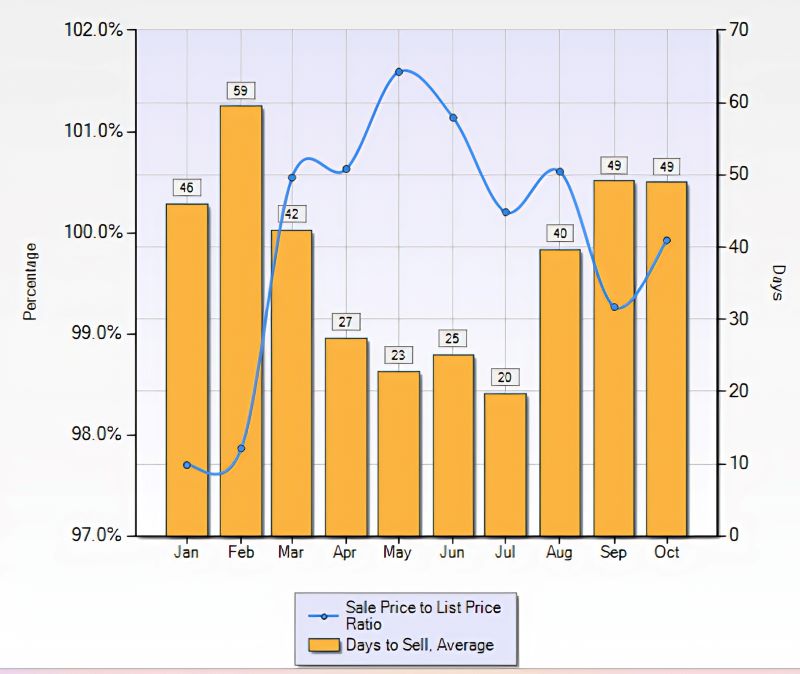

What’s happening with the pace of home sales and prices in SLV? Given the 30 year fixed rate mortgage hovered around 7.75% last fall, you’d have thought more homes would sell this year, but sales are nearly 10% slower than last year across Santa Cruz County. Nothing stops rising prices for single family homes in Santa Clara County, despite the $2 million plus average price tag. Homes there continue to sell at a rapid rate – within a relatively short 3 weeks of listing, compared to Santa Cruz County at 40 days.

About 1/3 of Santa Cruz County home sellers dropped their asking prices because they’re tired of waiting to get an offer. To many buyers, prices feel stubbornly high. Meanwhile, buyers may have longer to shop as many homes stay on the market longer. Still, plenty of competitively priced homes are selling in a week or less. Interestingly, there’s not much difference between the average listing prices and final selling prices between homes priced under or over $1 million in either SLV or Scotts Valley. I think the gains for the properties that were competitively priced are offset by the price reductions. On average, prices are still higher than last year, and sellers are still getting close to 100% of their original asking price; see table below.

Key Economic Takeaways

The chart above shows the relationship between the columns for Days on Market (DOM) until a property goes into escrow with a buyer and the ratio of final sales price to listing price shown by the dots and lines. Notice how sellers tend to get a price premium (when the sale to list price ratio is over 100%), the faster their property sells. This may be a factor to consider when setting your asking price. Today’s buyers are so market savvy —from doing their research before shopping — that it is a mistake to set the property’s asking price too high.

Nationwide, Fannie Mae’s survey revealed that 42% of consumers think mortgage rates will fall over the next 12 months – the largest share ever! 39% believe home prices will go up, 23% think prices will fall, and 37% think prices will be flat. Home buyers and sellers are out of sync: 80% of buyers think it’s a bad time to buy, while 65% of sellers think it’s a good time to sell.

The US economy grew last quarter by nearly 3.5%! Consumer spending (accounting for about 70% of economic growth) is on the rise, driven by a surprising spending spree led by the affluent. Not surprisingly, the disparity between the haves and the have nots is growing across the US. Here are some surprising statistics: about 80% of stock market wealth is owned by the wealthiest 10%. Since the beginning of 2020, stocks and mutual funds have appreciated 85%. Similarly, the top 10% have seen their home equity increase by about 70% since the beginning of 2020. Their increased net worth is nothing short of phenomenal.

Meanwhile, the majority of the lower and middle class in the US are struggling. Inflation – the rising cost of housing, groceries, gas and necessary consumer goods – disproportionately hurts the middle and especially lower income earners. Inflation wasn’t caused by who was in the white house: inflation was a global concern both during and after the pandemic – directly traceable to supply chain disruptions.

Housing costs are cited as a growing concern for renters – over 55% of whom are spending over 30% of their income on housing. California remains the most expensive housing market in the US. Meanwhile, wages are increasing, but not fast enough to offset inflation. Experts think it will take years for wage growth to catch up with the higher cost of goods. Fortunately, employment across the Bay Area rose by a strong 6,700 jobs: the region accounted for just under half of the new jobs in California!

Listing Spotlight – Katy Harrison , the agent at William Way should get you her materials soon

Need a local expert REALTOR®? Reach out to us today – we’d love to guide you!

Send your questions & topic requests to “M.C.” (MaryCatherine) Dwyer, MBA, REALTOR®

mcd@mcdwyer.com mcdwyer.exprealty.com

CA DRE License 01468388 EXP Realty of California, Inc.

Serving San Lorenzo Valley and Scotts Valley since 2005

Sources: Bank Rate, Bloomberg, California Association of REALTORs, CNBC, CNN, MLS, Mercury News, Mortgage News Daily, National Association of REALTORs, Redfin, Reuters, Wall Street Journal and Zillow, as of *press deadline 10/18/2024. The statements and opinions contained in this article are solely those of the individual author and her sources, and do not necessarily reflect the positions or opinions of eXp Realty, LLC, or its subsidiaries or affiliates (the “Company”). The Company does not assume any responsibility for, nor does it warrant the accuracy, completeness or quality of the information provided.

The San Lorenzo Valley Post is your essential guide to life in the Santa Cruz Mountains. We're dedicated to delivering the latest news, events, and stories that matter to our community. From local government to schools, from environmental issues to the arts, we're committed to providing comprehensive and unbiased coverage. We believe in the power of community journalism and strive to be a platform for diverse voices.