Commentary: Examine the SLV Water District’s Finances when Deciding How to Vote on the Surcharge

By Bob Fultz

I’m a member of the San Lorenzo Valley Water District Board of Directors, but I’m speaking only for myself in this letter. As someone who has had a professional career in technology strategic planning and finance, where we constantly look for the critical items that move an organization forward, the first step in that journey is understanding the past and the present. I believe that Our District is at a critical inflection point.

I say “Our District” because it is “Ours”. It’s a public agency. As owners, our primary concern must be finances, especially over the long term. Let’s explore the growth of the District’s rates and operating expenses over the last 25 years (with an emphasis on the last 8 years) and how this growth relates to the district’s financial obligations.

The District’s numbers since 1997 (through June 30, 2022 as budgeted and if the surcharge passes):

- Water rates have increased at a compound average rate of about 6.8% per year

- About 11.6% a year or 168% in total since 2013

- Operating expenses have increased at a compound average rate of about 5.8% per year

- About 7.1% a year or 86% in total since 2013

- Inflation has remained steady at about 2% per year

- About 2% a year or 16% in total since 2013 (through June 2021)

- About 82 cents of every dollar collected by the District in Operating Revenue has been consumed by Operating Expenses

- 81 cents since 2013

- The 2017 rate increase also resulted in a $1.8 million increase in operating expenses—from about $5.9 million on June 30, 2016 to about 7.7 million on June 30, 2018 (or a 31% increase)

- Compared to a $2.4 million increase in operating revenue between 2016 and 2018, meaning about 75% of that revenue increase was consumed by operating expenses

- A modest increase may have been justified but a 31% increase in 2 years is huge

- That’s an additional $1.8 million per year since 2018 not being applied to capital obligations

- In my opinion, we need to “change the course” with respect to operating expenses in order to invest more into infrastructure and other capital obligations while keeping rates affordable for all so we can pass along a viable and financially sound District to the next generation.

Our agency makes money by selling water to our community. It costs money to collect the water from our surface sources and wells, treat the water so it is safe to drink, and then distribute the water to every home in our community.

The money made selling water is operating revenue. The money expended to produce and deliver the water is operating expense. Operating revenue minus operating expense is Operating Margin.

In addition, our District must have funds: (a) to cover emergencies and disasters (reserves), (b) to pay for the retirement of its employees, and (c) to maintain the system by maintaining, improving and replacing infrastructure. The Operating Margin is used to cover these costs.

Recently we saw how critical reserves are. As everyone knows, the CZU wildfire destroyed portions of the District’s collection and distribution systems. Prior to the CZU wildfire, the District’s reserves were approximately $4.8 million dollars. Emergency repairs to our system incurred a cost of approximately $3.4 million dollars. Having that money in reserves meant that we could do temporary repairs quickly. We didn’t have to wait for the federal or state government to help or try to get an emergency loan before starting repairs. And we were more than fortunate that our brave and hardy fire department volunteers (and others helping them) “held the line at 9” so that the damage to our community—and the District—was not greater.

Repair and replacement of the system costs a lot. This is because the District is a “capital-intensive” entity. This means that incredibly large sums of money must be spent to maintain its viability. In order for capital-intensive entities to be viable over the long haul, they must generate a lot of Operating Margin to fund the system’s repair and replacement. This means that the Operating Margin must be kept as large as possible—and increased where possible. That is done by generating more operating revenue (selling more water) and/or by efficiently managing operating expenses (not spending as much).

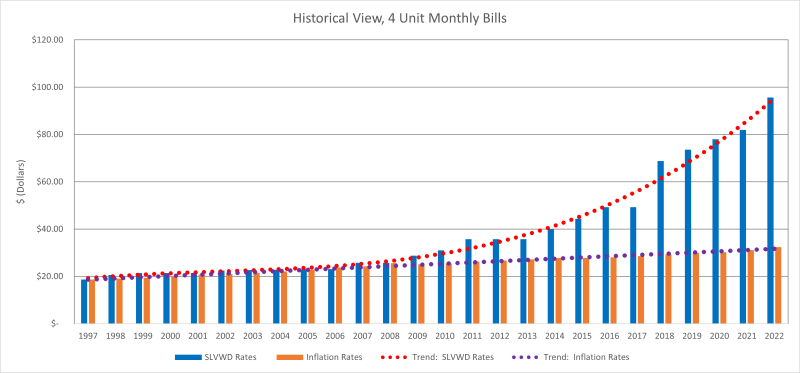

In our community, even an operating monopoly like District can only charge so much. We all know that our water rates have skyrocketed over the past 8 years. For example, a household using 4 units of water a month (about 3,000 gallons) paid $35.71 in 2013. As of this fall, that same 4 units will cost $95.96 with the CZU fire recovery surcharge—if it passes. If past trends continue into the future, a 4-unit water bill is set to double in about a decade.

This chart illustrates the trends for (a) SLVWD bills since 1997 (blue bars and orange dotted line) compared to (b) what bills would have been had rates increased only by inflation (orange bars and purple dotted line)—for a residential customer using 4 units of water—with the proposed surcharge.

In addition, the District is also what is known as a “high fixed cost” entity. This means that the cost of operating the District, all other things being equal, is about the same if it sells more water than it does now or less water than it does now. Yes, there are some costs that vary with quantity of water sold—e.g., water treatment chemicals, power (for pumping) and maintenance. But these variable costs are smaller than the fixed costs. So, again, in order to generate as much cash as possible for Operating Margin, these operating expenses much be efficiently managed over the long term.

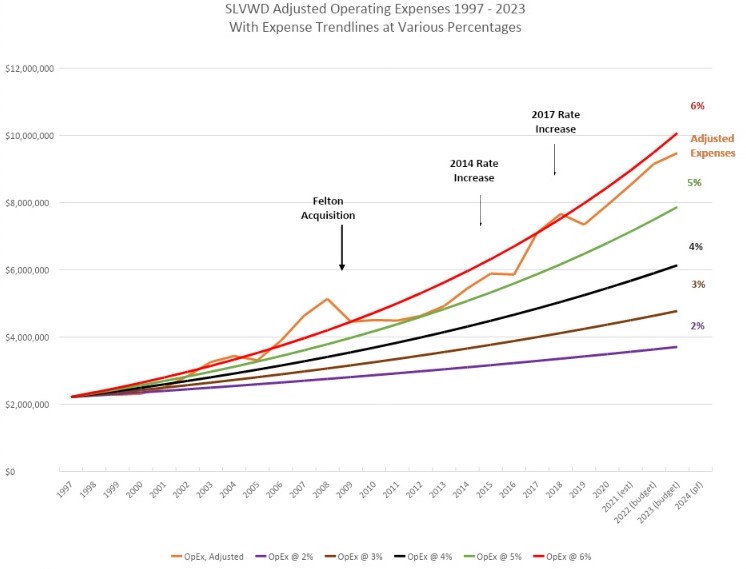

So how has the District done with respect to managing its operating expenses? I’ve gone back to 1997—almost 25 years ago—and extracted total operating expenses from the annual reports available here: https://www.slvwd.com/finance/pages/annual-financial-reports and combined these with the budgeted operating expenses through 2023. The District’s operating expenses are shown in the chart below as the orange line.

However, I’ve then made some adjustments to the numbers to reflect the fact that several areas that are part of the District now were not part of the District in the past. These include: Manana Woods in Scotts Valley, Felton, Lompico, and Olympia Mutual. In order to make sure we are making appropriate comparisons, I’ve adjusted the operating expenses as if those communities had been part of the District since 1997 (the orange line below).

This chart illustrates the trends for adjusted operating expenses (orange line) compared to what operating expenses would have been had they increased by various percentages—2%, 3%, 4%, 5%, and 6%—per year.

As you can see, the actual operating expenses have grown at a compound average rate of about 5.8%, or about 2.9X the rate of inflation.

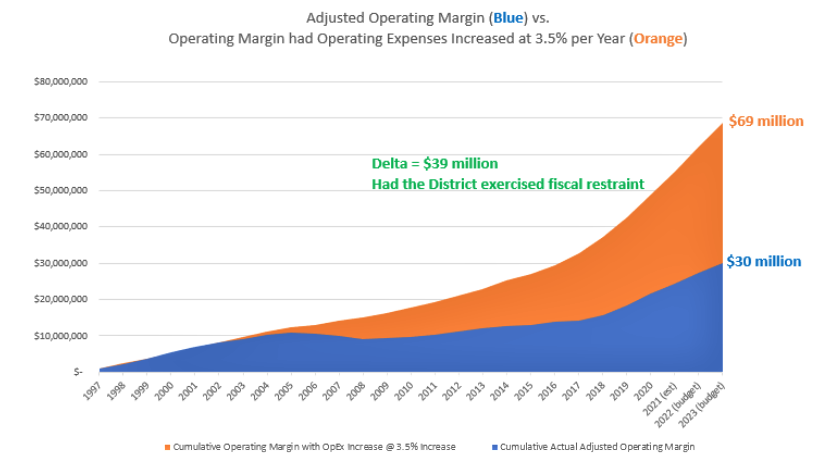

From June of 1997 through June of 2023, the District will have accumulated approximately $30 million dollars of Operating Margin (adjusted).

Now, imagine that the District had grown its adjusted operating expenses since 1997 at only 3.5% per year. That is still 1.75X of inflation so it is still a healthy increase every year. The accumulated Operating Margin through 2023 would be about $69 million. The additional $39 million could have addressed many capital obligations that have built up over the years (including approximately $10 million in deferred tank maintenance not performed and overdue). And, perhaps, we could have seen a lower rate of increase in our water bills as well. You can see the difference in Operating Margin in the chart below:

I believe that we can all agree that rate increases of some amount are required periodically. After all, even inflation at 2% has an impact on operating expenses over time. And I’m sure that addressing our capital obligations was clearly the intention when the last two rate increases were passed, based on the press releases associated with them: https://www.slvwd.com/sites/g/files/vyhlif1176/f/uploads/slvwd_rate_increase_decision_press_rls_10_25_13_final.pdf and here: https://www.slvwd.com/sites/g/files/vyhlif1176/f/uploads/rate_increase_approval_press_rls_9.22.17.pdf.

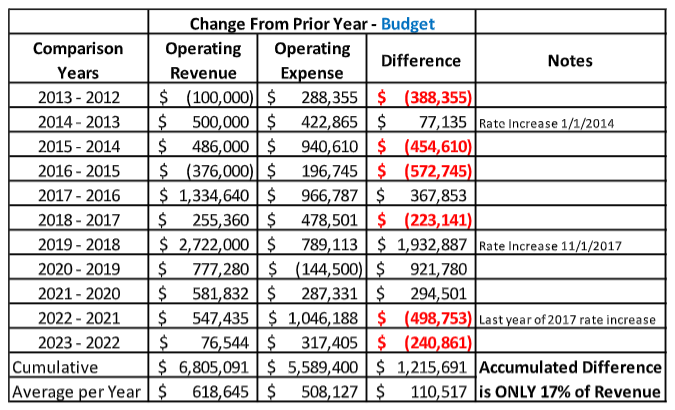

Unfortunately, the fiscal restraint needed during the budget process, to make reality match those good intentions, is, in my opinion, still not yet in place. Instead, my view is that we remain on a hamster wheel, where budgeted rate increases are mostly applied to increases in budgeted operating expenses, meaning that we aren’t making more progress to address the District’s capital obligations. The table below shows that trend. Where, over an 11-year period (the last two rate increases), your Boards have allocated 83% of the increases in operating revenue to increases in operating expenses.

I am not willing to accept these results and so I’ve voted against the 2021, 2022, and 2023 budgets. I will continue to vote against the proposed budgets until there’s a commitment to fiscal restraint with respect to operating expenses.

While we can’t change the past we can make a different future by moving off our current trajectory. If your Board were to establish a policy to increase operating expenses by, say, 3.5% annually (on average), then over time we, as owners, will see two benefits: (a) a slower rate of increase in our water bills and (b) significantly larger sums of money going towards infrastructure and other capital obligations that the SLVWD has incurred over the past few decades.

At this point, you’re probably asking yourself “what can I do?” Actually, you can do a lot. As the Owners of this District, you are in charge as long as you exercise your power as Owners.

Today, this means that you can also protest, via the Proposition 218 process, this proposed surcharge and, in the future, any proposed rate increase until the Board develops a restrained budget that slows the rate of growth in operating expenses, clearly outlines the magnitude of our capital obligations, and provides a concrete plan on how to pay for them. Remember, the Proposition 218 process is a backward vote. You must submit a form by Aug 5th to vote No. Not voting is the same as voting Yes.

You can attend meetings where the budget is being discussed and make your views known. You can write letters, post on social media, and talk to your neighbors.

In the end, change happens when it is supported by a broad base of Owners—meaning all of you. The path to a healthy District with a stable fiscal policy, sound infrastructure, and with affordable water rates can only be achieved if we, acting as a community, take action. Thank you.

Bob Fultz is a member of the SLVWD Board of Directors, elected in 2018. Bob is a 30+ year resident of Boulder Creek. He has worked in Silicon Valley since 1984, serving in product development, strategic planning, and finance roles in a variety of established and start-up companies. As a consultant, Bob is currently CFO of a startup dedicated to bringing mobile communications to emerging economies around the world.

Featured photo of the San Lorenzo River by Thomas Andersen

The San Lorenzo Valley Post is your essential guide to life in the Santa Cruz Mountains. We're dedicated to delivering the latest news, events, and stories that matter to our community. From local government to schools, from environmental issues to the arts, we're committed to providing comprehensive and unbiased coverage. We believe in the power of community journalism and strive to be a platform for diverse voices.