Felton Fire Protection District Proposes Parcel Tax to Bolster Emergency Services

By Mary Andersen

The Felton Fire Protection District (FFPD) has drafted a resolution for a 2026 election for a new parcel tax aimed at supporting the sustainability of its fire protection and emergency medical services. The resolution, posted now for public feedback, requests that the Santa Cruz County Elections Department conduct an all-mail election for residents within the district’s boundaries. Here’s a breakdown of the key points for the community to understand.

Why is the tax needed?

The FFPD has determined that current property tax revenues are insufficient to cover its future staffing plans and the rising costs of maintaining and improving, equipment, facilities, and essential services. These include 24/7 emergency response, a new paid staffing model, modernizing equipment, and ensuring firefighter safety and training. After internal reviews and meetings in 2025, the district concluded that without additional funding, it cannot maintain current service levels or meet its responsibility to protect lives and property. If the tax measure fails, the FFPD may dissolve and either merge or contract with a neighboring district. The district currently receives $1,080,000 annually based on a longstanding parcel tax formula that has not been updated in decades.

What would the tax fund?

The proposed “Felton Fire Revitalization and Sustainability Ordinance” would impose an annual parcel tax of between $682 and $2000 on properties, with variations and additions based on property type and size as outlined by the Santa Cruz County Assessor’s use codes. The tax is expected to generate approximately $1.6 million annually, which would be used exclusively for:

- Maintaining and improving fire protection and emergency medical response.

- Ensuring 24/7 staffing with a mix of paid and volunteer firefighters.

- Recruiting and retaining qualified firefighters and EMTs with updated training and equipment.

- Supporting a competitively paid Fire Chief.

- Replacing and maintaining essential equipment, vehicles, and facilities.

- Expanding community education and fire safety programs.

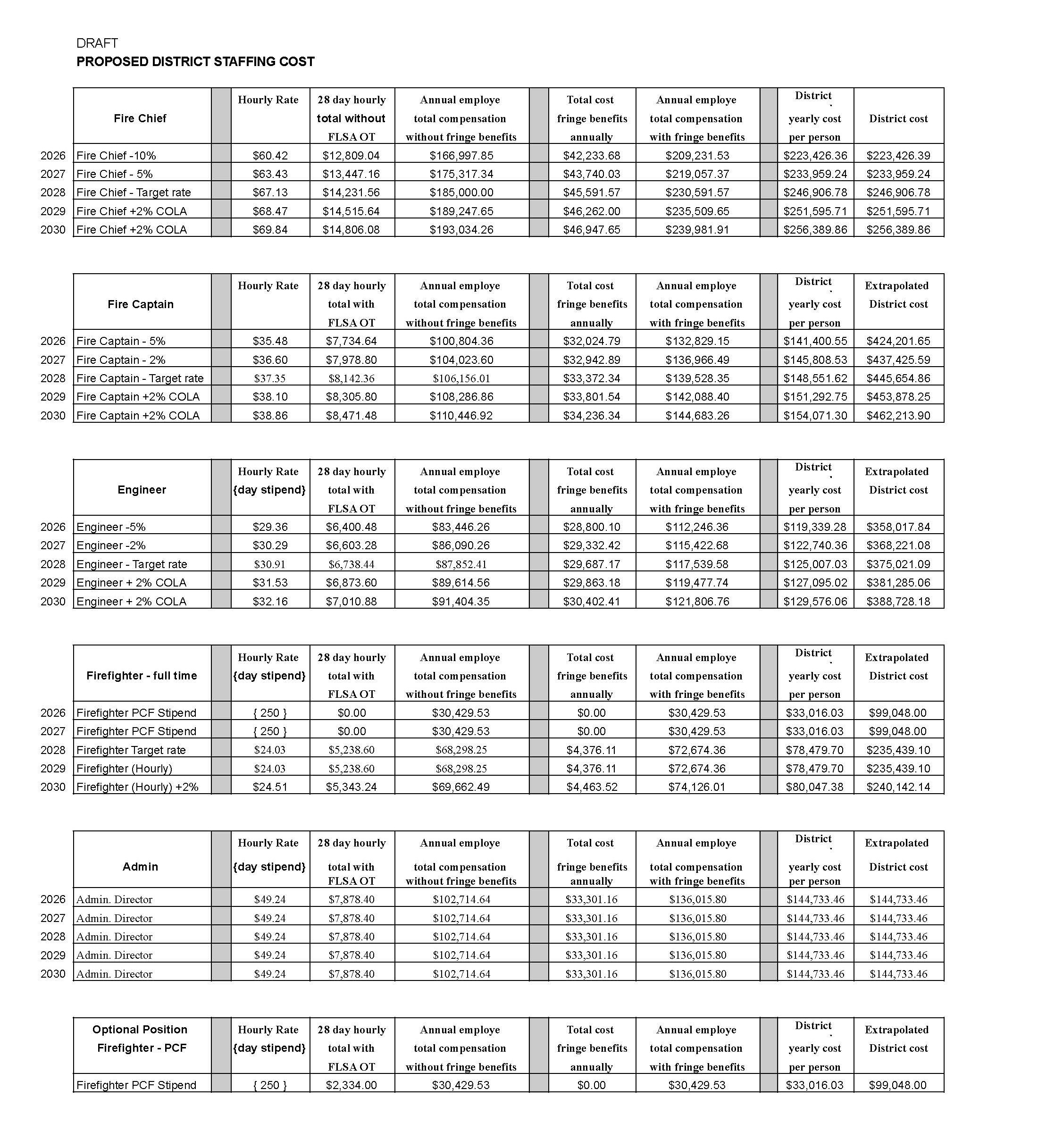

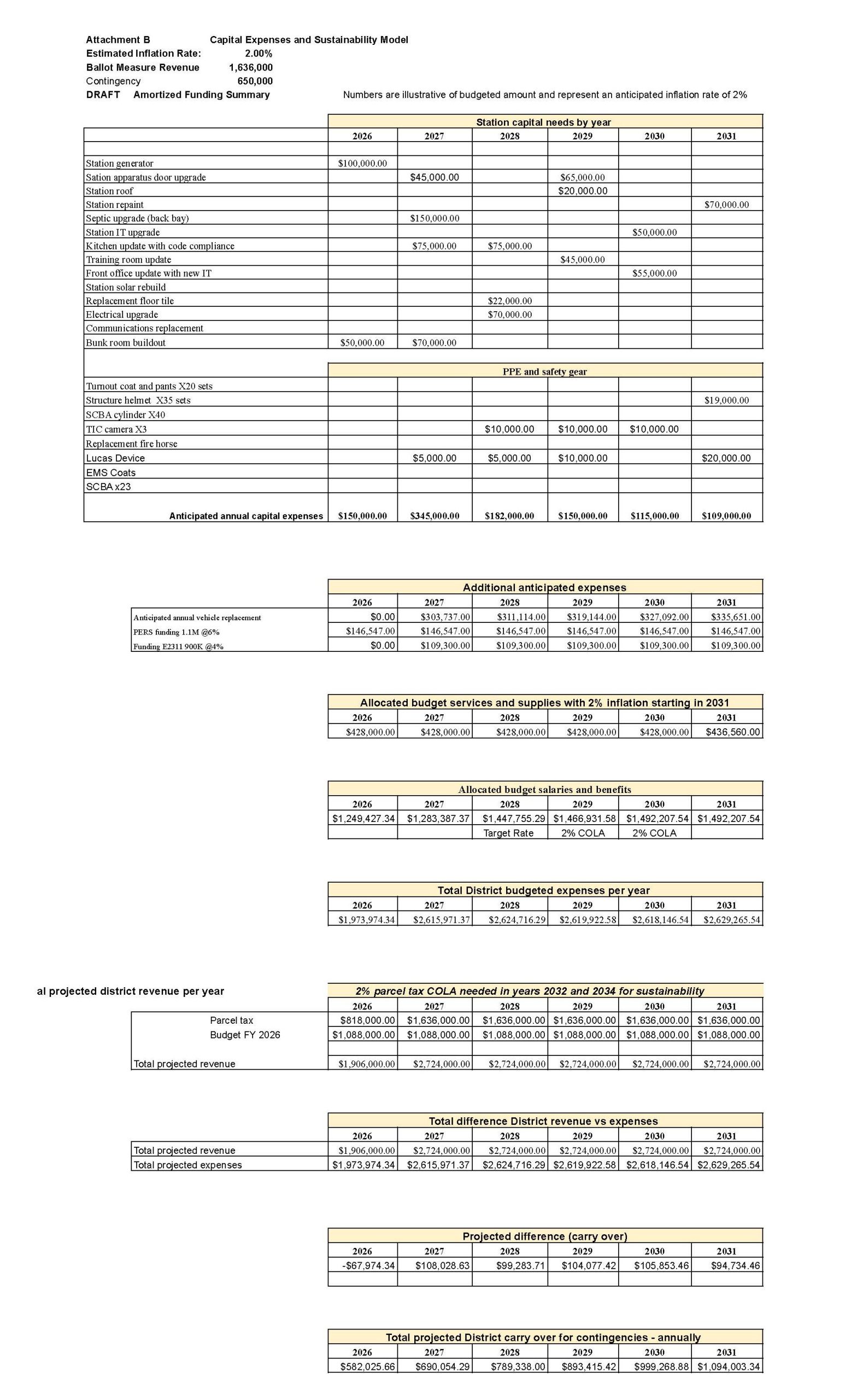

Click to enlarge Proposed District Staffing Cost (draft) and Capital Expenses and Sustainability Model documents below:

How would the tax work?

The tax would begin in the 2026–27 fiscal year and be collected through the Santa Cruz County property tax roll, alongside regular property taxes. The base rate is $682 per parcel, but fees vary depending on property use. For example:

- Single-family homes would pay $682.

- Single-family homes with an ADU, granny unit, or other external building would pay $757.

- Multi-unit residences, like duplexes, apartment complexes, may incur additional per-unit fees (e.g., $757 for a duplex, $907 for 3-4 units).

- Multiple units on a single parcel would pay $1023

- Commercial properties, such as grocery stores, restaurants, lumber yards, etc. would face higher fees (e.g., $1,200–$2,000).

- Vacant or agricultural land may have lower fees (e.g., $50–$350), and certain properties, like government-owned land or churches, are exempt.

A detailed fee schedule based on county assessor codes is available in the document below for reference.

Accountability Measures

To ensure transparency, the draft proposal states that FFPD will:

- Deposit all tax proceeds into a dedicated account for fire and emergency services.

- Establish a Citizens’ Oversight Committee (3–5 members, independent of district employees or vendors) to review expenditures.

- Publish an annual report detailing how funds are collected and spent, available by January each following year.

Community Input and Duration

The tax requires approval by two-thirds of voters with an election date to be determined. However, the district is exploring options for a simple majority vote. If approved, it will remain in place unless repealed or amended by voters or the FFPD Board. Every five years, starting in 2030–31, the district will conduct a public reassessment to evaluate the tax’s necessity and effectiveness, ensuring community input. Any increase to the base rate would require another voter approval. To provide feedback on the parcel tax proposal (see below) and supporting documents, contact Chief Isaac Blum at firechief@feltonfire.com.

What’s at stake?

The ballot question emphasizes that a “Yes” vote supports the tax to maintain and enhance FFPD’s services, while a “No” vote could lead to the district’s dissolution and merger or contract with a neighboring fire district. The Santa Cruz County Elections Department will manage the election, with costs reimbursed by the FFPD.

For more details on the tax or to look up your parcel’s specific fee code, visit the Santa Cruz County Assessor’s website at sccgis.santacruzcountyca.gov/gisweb/.

View Felton Fire Protection District’s board meeting agendas and minutes, and other public documents, visit feltonfire.com.

Mary Andersen is a journalist and Publisher of the San Lorenzo Valley Post, an independent publication dedicated to the people, politics, environment, and cultures of the Santa Cruz Mountains. Contact mary@slvpost.com