Fall’s Chill Puts a Damper on Home Sales from Boulder Creek to Scotts Valley

By M.C. Dwyer

Lower mortgage rates may help — but affordability and insurance still weigh heavily in buyers’ minds.

Mortgage Rates & The Economic Backdrop

After weeks hovering around 6.38%, the average 30-year fixed mortgage rate dropped below 6.25% at press time. That’s near the lowest point in the past 12 months, but hasn’t yet sparked as much buyer commitment as hoped.

The Federal Reserve’s rate cut in September was widely anticipated. Still, the change matters on a symbolic level: the Fed has openly said that they believe inflation, now around 2.9%, may be easing enough to allow them to cut rates again this year.

National Headwinds Meet Local Realities

Nationwide, new listings rose 4% last month, but pending sales fell by 1% — the biggest drop in five months. Buyers remain cautious, since nearly ¼ feel insecure about their jobs. Buyers are perplexed why home prices are still appreciating in many areas. Home tours, however, are up 15% year-over-year, showing that curiosity is back, even if commitment is lagging.

In California, consumer sentiment and labor confidence both slipped in September. Nationally, about ¼ of poll respondents think it’s a good time to buy. Job concerns increased: now about ¼ of workers fear losing their job in the next year.

The federal government shutdown is delaying the issuance and renewal of national flood insurance policies, snagging up the loan process, affecting up to 1,400 home sales a day. The longer the shutdown lasts, the more economic unease builds up.

Santa Cruz Mountains Snapshot

The combination of more homes for sale and increasing price reductions translates into a buyer’s market by most standards.

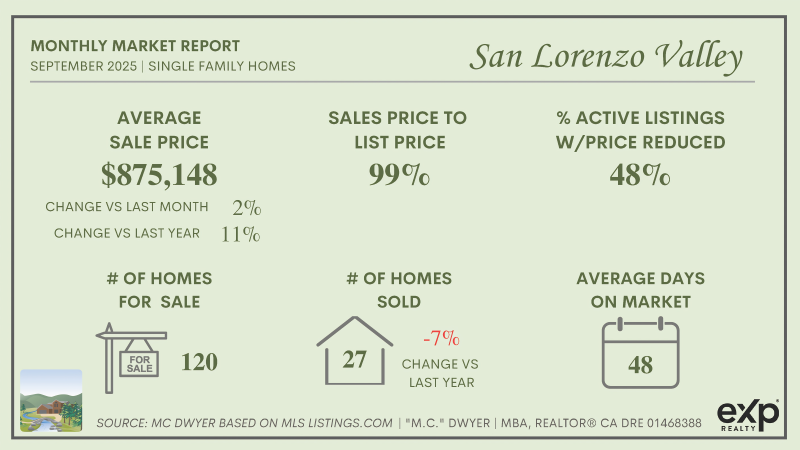

San Lorenzo Valley (SLV)

Our local market follows seasonal patterns, but this fall was rainier sooner than last year. September’s sales volume chilled about 7% lower, probably because average sales prices rose another 2% for the month and over 10% year-over-year. Inventory — the number of homes for sale — rose almost 15% in September, essentially leading to nearly 50% of sellers to reduce their asking prices. Most buyers in the SLV face higher rural insurance costs, many left with no choice but the Cal Fair Plan. (More later.) Combined, these forces led to days on market -until a property finds a buyer-to 48 (an improvement over last month’s 63).

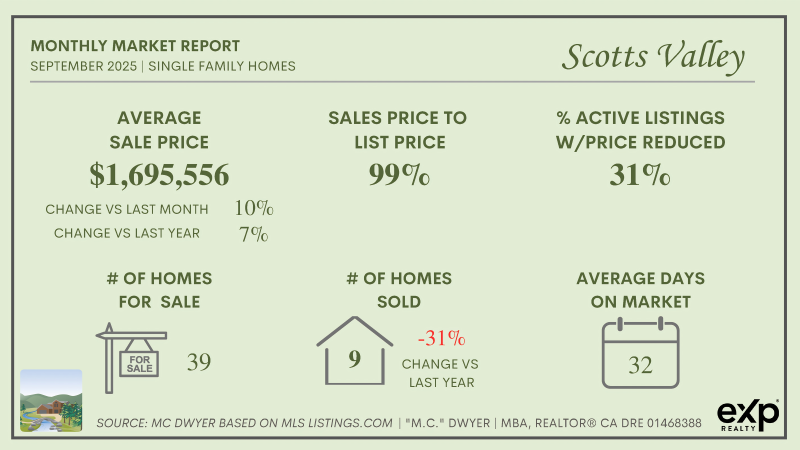

Scotts Valley

Scotts Valley’s higher-end market looks more resilient, yet sales volume chilled by over 30%. Average sale prices rose about 10% over last month and 7% over last fall (though slightly below summer’s highs). Inventory hit six months’ supply in September, essentially forcing a whopping 62% of Scotts Valley home sellers to drop their prices. Homes priced competitively and in top condition continue to attract attention quickly, keeping days on market an average 30.

Across Santa Cruz County

The Inventory of Single Family Homes grew to over five months. By traditional definitions, 5-6 month’s inventory creates a market evenly balanced between sellers and buyers. Nearly half of home sellers have already reduced their prices, and sales prices are falling slightly from last month and last year. Supported by lower prices, the rate of sales was stable compared to last month.

Big Picture: Stability and Strain

The U.S. economy remains surprisingly stable despite the swirl of tariffs, job worries, and a drawn-out government shutdown. But over the past five years, Goldman Sachs reports the cost of homeownership has jumped 26%. The cost of homeownership as a share of income has jumped from 33% to 51% since 2000. Rent jumped from 21% to 29%, health care 10% to 16%, etc.. As a consequence, all generations, from Gen Z through Gen X, have found it challenging to save enough for retirement.

Despite those headwinds, the fundamentals of housing remain strong. Real estate continues to represent the world’s largest asset class, worth $393 trillion globally. Demand for housing here is driven by our idyllic weather, scenery, and parks — combined with our ideal location between far more expensive housing in Silicon Valley and Santa Cruz.

Presenting problems to many homeowners and would-be buyers, the California FAIR Plan has requested a sizzling hot average 35.8% rate hike in fire insurance rates, with some homeowners facing 40–55% increases. This is a relatively new barrier to buyer affordability, particularly in our rural areas where private insurers remain scarce to non-existent. It remains to be seen how the California Insurance Commissioner negotiates on behalf of us consumers. I think the handwriting is on the wall: the rural fire insurance market is in crisis and higher rates will persist as climate risks spread — even if more insurers come back into the rural market.

Technology & Trust

Even as AI reshapes how buyers research homes and becomes an ever larger part of building their knowledge, 90% still rely on REALTOR®s for accurate guidance. For now anyway, REALTORS® have the edge over AI because of our deep understanding of local market nuances — the quirks of regulations and neighborhoods, the realities of insurance and infrastructure, and sheer experience of negotiating through the complexities of rural transactions.

AI summaries serve up data, but only an experienced local REALTOR® can explain why two homes with the same profile command different prices — or how to put a complex inspection report into the broader perspective of what’s common and what’s not.

Outlook: A Market Catching Its Breath

While home prices remain historically high, appreciation slowed nationwide to 1.4% year-over-year, the lowest pace in two years

For buyers with confidence in their jobs, who’ve been waiting for lower rates, remember that the mortgage market has already priced in the likelihood of future Fed rate cuts! If 30 year fixed mortgage rates persist at 6.25% or lower, having more homes to choose from amid slower price growth could just ignite a warm and cozy home-buying opportunity this fall. It’s even possible committed buyers may soon have the upper hand with some sellers — because the number of home shoppers often declines between the holidays into, say early next year. It’s a sure way to take advantage of less competition this time of year!

Sellers The old idea of pricing high, to leave wiggle room for negotiations, doesn’t work anymore. Today’s buyers are incredibly well informed about prices! Some buyers simply ignore overpriced properties. And some agents will show an overpriced home simply to drive home the appeal of offering on a lower priced property. You can overcome this chilly fall market by prepping your property for sale, following your agent’s guidance, pricing correctly from launch, to enjoy a smoother sale process. It’s clear sellers who’re hanging on to their optimistic prices from summer face the possibility of paying holding costs on their overpriced listing through the winter. Competitive price positioning is everything: the difference between “for sale” and “sold” may be how well property owners listen to their REALTOR®’s explanation of recent comparable sales and pending sales, and recommended improvements, making your property the best value in the area.