Fire Recovery: Chris Copeland Offers Insurance Education and Assistance

By Antonia Bradford

When the CZU fire hit the San Lorenzo Valley, Scotts Valley resident and retired insurance adjuster Chris Copeland knew right away that families who lost their homes would have a second battle in front of them – figuring out their insurance policies and contending with insurance companies. What he didn’t expect was the mistreatment that so many fire families were reporting.

“I don’t even know where to begin, there are so many missteps taking place. At this point it’s like trying to bail out the Titanic with a spoon,” Copeland said.

Copeland retired after 28 years working as an Assistant Vice President at Chubb Insurance. Having processed many large claims, the highest being $68 million, and the Oakland fire, he saw right away an opportunity to help his mountain community recover by educating people about their policies.

Motivated by the families and their children, Copeland started hosting free small, socially distanced classes on his deck at his Scotts Valley home.

“I had a fear of these children not having stability. Not having a home,” Copeland said when asked what motivated him to offer his services to the fire community. As time has passed however, he quickly realized that the focus on his classes were going to need to shift. Instead of just educating people on their policies, he was going to have to give the fire victims tools to battle their insurance companies so that they got everything they were entitled to.

Throughout San Lorenzo Valley, fire families are reporting contentious battles with their carriers. Unreturned phone calls. Low ball bids. Complete silence from their adjuster. Some felt they had no other option but to hire public adjusters, who often charge up to 10% for their services. Others are hiring legal representation.

“The adversarial dynamics have been the biggest surprise for me,” Copland said. “The carrier is supposed to be on your side, you are their customer. They are supposed to take care of you. These are not people asking for a handout, they have paid their premiums. However, that is how they are being treated.”

According to Copeland, there are basic things fire victims can do to change the narrative and put their insurance companies on the defensive.

“Document everything. When the adjuster tells you that you are entitled to X only, tell them to show you in the policy where it says that. Get your own estimates, their estimates will not be accurate or high enough.”

Saturday March 27 at 2:00 pm, Copeland is hosting a class at the Bear Creek Community Center to help more fire families. He will be covering State Farm from 2:00 to 4:00 pm, and all other carriers from 4:15 to 6:15. Bring your full policy and a three-ring binder. Unfortunately, due to privacy issues this class cannot be streamed or recorded. For details, visit facebook.com/events/195500885674745

If you can’t make the class Copeland is offering to meet and chat with individuals. He can reached at cjpcopeland@gmail.com.

Antonia Bradford lives in Boulder Creek with her husband and five children. She is a writer, artist, and business owner. She is an advocate for fire families in the area having lost her own home in Boulder Creek. Antonia is committed to making contributions to the San Lorenzo Valley community wherever and however she can.

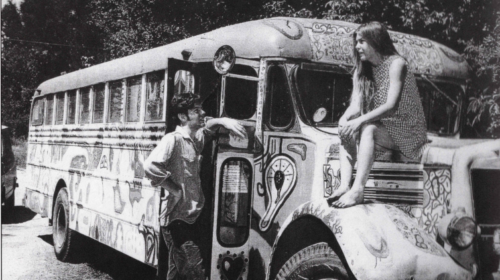

Featured photo: Chris Copeland and Kaylee. Photo by Antonia Bradford.